Here are two fun charts.

The first shows that active management of mutual funds adds no value.

The blue line shows the actual performance of actively managed mutual funds after fees have been taken into account. The red line shows randomly distributed results. Even at the right (high performing) end of the graph, the active managers still don’t outdo chance. Put your 401k into index funds.

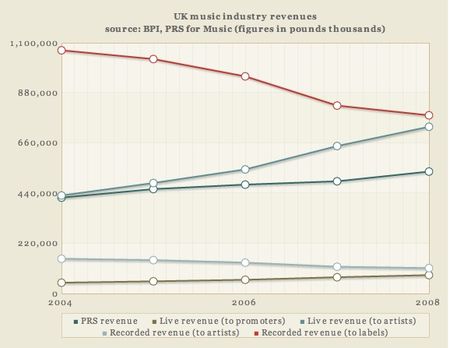

The second chart shows that while record labels are suffering, actual recording artists are seeing their income increase.

This maps pretty closely with what I’m seeing in the music industry. Lots of great music being made, lots of good shows out there to go to, and increasing availability of music at lower prices. The changes in the music industry are good for consumers, and it looks like they may be good for artists as well. The fact that they’re bad for record labels is a bonus.

December 1, 2009 at 4:53 pm

Are you sure “index funds” are the same thing as “randomly distributed results”? An index fund invests in everything (in it’s index). I assume a randomly distributed selection would be some subset of everything. Maybe it doesn’t matter, statistically.

December 2, 2009 at 9:20 pm

The main stock indexes are actively managed to keep them to a representative cross-section of the non-pathological companies out there, although not to attempt directly to judge their prospects. The wider the range they cover the better for using it as a fund.

I use exactly one method in transferring allocations (which I do very rarely). This is picking a particular factor that I think is likely to change and finding funds – I can only trade funds in my 401k account, sensibly, and there are penalties for churn – that map well to that factor. Gross mappings to gross factors of change, not “Someone might give a speech on something sometime” but “The US dollar is in a long slide for structural reasons that have not been fixed.” Case in point: targeting the slow decline in US dollar against the Euro over 2004-2008, picked various dull Euro-investing funds, rode the exchange rate. Mid-late 2008 as the foreclosure wave started to become very obvious, the target was: get away from the crazy people before the crazy people notice; got into cash completely just about on time. Early 2009, thinking the likelihood of a technical end to the recession soon is reasonable and anticipating a re-frenzy of stock prices, target US index funds, bought S&P 500, sat on it until it became clear that employment is still screwed, sold it with a decent gain recently, but this next is high-risk; if stock prices keep creeping upwards and an employment plan comes to pass (and I really hope it does) then I might miss out. Right now I’m more concerned that once the stimulus is clearly playing out but unemployment is still rising, there will be a panic in the market. Now after that, if the government looked like it was going to finally take unemployment seriously with a WPA and so on, I would buy right back into US index funds. But we’re a ways off. In the meantime I have cash and no strategy and that makes me less nervous than having a strategy I don’t think is very good.